|

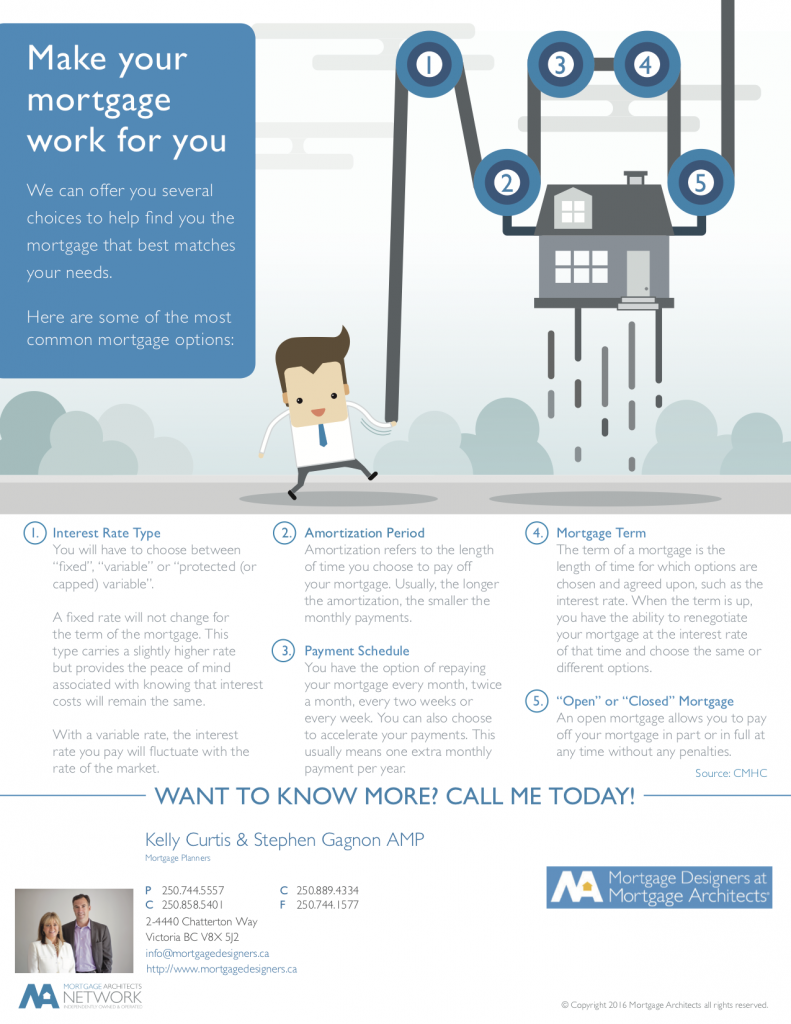

We’re making your mortgage work for you by offering you several choices to help find you the mortgage that best matches your needs. |

|

Here are some of the most common mortgage options:1. Interest Rate TypeYou will have to choose between “fixed”, “variable” or “protected (or capped) variable”. A fixed rate will not change for the term of the mortgage. This type carries a slightly higher rate but provides the peace of mind associated with knowing that interest costs will remain the same. With a variable rate, the interest rate you pay will fluctuate with the rate of the market. 2. Amortization PeriodAmortization refers to the length of time you choose to pay off your mortgage. Usually, the longer the amortization, the smaller the monthly payments. 3. Payment ScheduleYou have the option of repaying your mortgage every month, twice a month, every two weeks or every week. You can also choose to accelerate your payments. This usually means one extra monthly payment per year. 4. Mortgage TermThe term of a mortgage is the length of time for which options are chosen and agreed upon, such as the interest rate. When the term is up, you have the ability to renegotiate your mortgage at the interest rate of that time and choose the same or different options. 5. “Open” or “Closed” MortgageAn open mortgage allows you to pay off your mortgage in part or in full at any time without any penalties.

Download and print Making Your Mortgage Work For You Information Hot SheetWANT TO KNOW MORE? CALL ME TODAY! Kelly Curtis & Stephen Gagnon AMP Mortgage Planners Source: CMHC P 250.744.5557 |

|